HSB Economic Development Update - December 2023

December 07, 2023

- William R. Johnson

The HSB Economic Development team published their December 2023 news update, highlighting the following topics:

2024 County Tiers Set for JTCs, Fee in Lieu and Tax Moratorium

Each year, South Carolina's 46 counties are designated as being within one of four "tiers" for job tax credit and job development credit purposes based on a county's unemployment rate and per capita income. On December 7, 2023, the SC Department of Revenue has published the 2024 designations.

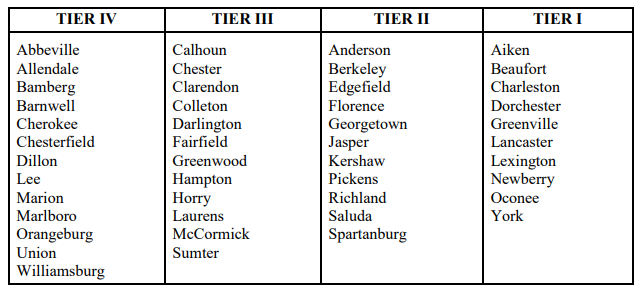

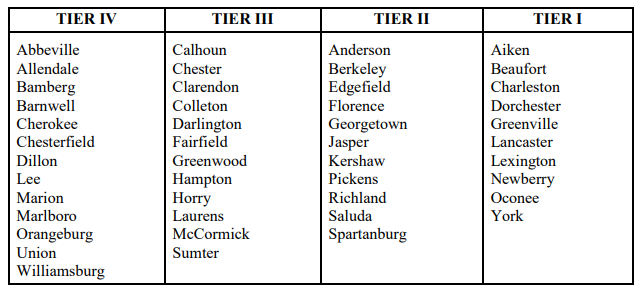

Below is a complete list of counties and their respective tiers for 2024. The following changes occurred from 2023 to 2024:

Abbeville (moved from Tier III to Tier IV for 2024)

Berkeley (moved from Tier I to Tier II for 2024)

Calhoun (moved from Tier II to Tier III for 2024)

Chester (moved from Tier IV to Tier III for 2024)

Chesterfield (moved from Tier III to Tier IV for 2024)

Dorchester (moved from Tier II to Tier I for 2024)

Hampton (moved from Tier II to Tier III for 2024)

Jasper (moved from Tier III to Tier II for 2024)

Kershaw (moved from Tier I to Tier II for 2024)

Lancaster (moved from Tier II to Tier I for 2024)

Richland (moved from Tier I to Tier II for 2024)

2023 projects in counties moving up a tier (Chester, Dorchester, Jasper, and Lancaster) should file Form SC616 to lock in South Carolina job tax credits at the higher level associated with the lower tier. This filing is a good option for any project in a Tier II, III, or IV county at the time of initial staffing as it can only help the taxpayer by protecting the taxpayer from a reduction in credits if the applicable county tier improves in a subsequent year.

The income tax moratorium counties for 2024 are Chesterfield, Dillon, and Marlboro, and Marlboro county further qualifies for the reduced $1 million investment threshold for FILOT agreements.

Per Capita Income Figures

On November 30, 2023, the South Carolina Department of Revenue released Information Letter 23-16, setting forth the updated per capita income level for the state at $53,618, up from $52,467 a year earlier. Please access the link to view the county per capita income levels. The state per capita income is relevant for the small business job tax credit, in which a taxpayer with 99 or fewer employees in an eligible industry increases employment by two or more new, full-time jobs. If the average wages of those jobs do not exceed 120% of the lower of the county or state average per capita income, the credits are cut in half. Notably, if the small business creates ten or more new, full-time jobs, the business qualifies for the full amount of job tax credits without regard to wages.

In addition, the state per capita income is relevant for purposes of defining a "qualifying service-related facility," which is applicable for both job tax credits and job development credits and which has become an increasingly important avenue for non-manufacturing businesses to qualify for key South Carolina incentives. Further, the figure is relevant to technology-intensive facilities for determining eligibility for the sales and use tax exemption for computer equipment, as well as for the state income tax credit on personal property expenditures associated with corporate headquarters projects.

Finally, job development credits are usually provided only for jobs paying at or above the county per capita income level at the time the initial application is approved (and adjusted every five years thereafter).

Tax Credit Reminders for 2024

Port Cargo Volume Credit

South Carolina Code § 12-6-3375 provides a tax credit to a taxpayer engaged in manufacturing, warehousing, or distribution that uses South Carolina port facilities and increases its port cargo volume at these facilities by at least 5% in a calendar year over its base year port cargo volume. Base year volume must be at least 75 net tons of non-containerized cargo, 385 cubic meters, or ten twenty-foot equivalent units. Form TC-30, "Port Cargo Volume Increase," is used to claim the credit.

It is important to note that tax credit applications should be submitted early in the year as the maximum amount that all taxpayers may claim pursuant to this section is subject to an annual cap. Tax credits may be taken against state income tax or as withholding tax refunds.

Agricultural Tax Credit

In 2018, South Carolina introduced a new program that provides a tax credit to agribusiness or agricultural packaging operations increasing their purchases of South Carolina agricultural products. If the "base year" of a company's purchases exceeded $100,000, and the company increased such purchases by at least 15%, the company can submit an application for credits against either state income or withholding taxes. The amount of the credits is determined by the South Carolina Coordinating Council, based on the information provided in the application. The credit may not exceed $100,000 per taxpayer in any one year. As with port cargo volume credits, these credits are also subject to an annual, statewide cap, so qualifying taxpayers should apply for credits as early in the year as possible.

Assessable Transfer of Interest Exemption

Taxpayers who purchased commercial (non-manufacturing) property in 2023 (or who own property which underwent an assessable transfer of interest (ATI) as defined in the South Carolina Real Property Valuation Reform Act) should consider taking advantage of statutory limitations on property tax increases for property taxed at a 6% assessment ratio. Taxpayers qualify for an “ATI exemption” equal to 25% of the fair market value of property that has undergone an ATI in 2023, provided that the ATI exemption may not reduce the taxable value of the property below the fair market value of the property prior to the ATI. In order to benefit from this limitation, the property owner must provide written notice to the applicable county assessor before January 30 of the year following the transfer. Taxpayers must proactively make the filing to capture the benefit of the ATI exemption. Failure to make the filing results in loss of this important benefit.

Click here to view the full update. Contact Will Johnson or a member of our Economic Development team for additional information on these topics or other economic development questions.

Each year, South Carolina's 46 counties are designated as being within one of four "tiers" for job tax credit and job development credit purposes based on a county's unemployment rate and per capita income. On December 7, 2023, the SC Department of Revenue has published the 2024 designations.

Below is a complete list of counties and their respective tiers for 2024. The following changes occurred from 2023 to 2024:

Abbeville (moved from Tier III to Tier IV for 2024)

Berkeley (moved from Tier I to Tier II for 2024)

Calhoun (moved from Tier II to Tier III for 2024)

Chester (moved from Tier IV to Tier III for 2024)

Chesterfield (moved from Tier III to Tier IV for 2024)

Dorchester (moved from Tier II to Tier I for 2024)

Hampton (moved from Tier II to Tier III for 2024)

Jasper (moved from Tier III to Tier II for 2024)

Kershaw (moved from Tier I to Tier II for 2024)

Lancaster (moved from Tier II to Tier I for 2024)

Richland (moved from Tier I to Tier II for 2024)

2023 projects in counties moving up a tier (Chester, Dorchester, Jasper, and Lancaster) should file Form SC616 to lock in South Carolina job tax credits at the higher level associated with the lower tier. This filing is a good option for any project in a Tier II, III, or IV county at the time of initial staffing as it can only help the taxpayer by protecting the taxpayer from a reduction in credits if the applicable county tier improves in a subsequent year.

The income tax moratorium counties for 2024 are Chesterfield, Dillon, and Marlboro, and Marlboro county further qualifies for the reduced $1 million investment threshold for FILOT agreements.

Per Capita Income Figures

On November 30, 2023, the South Carolina Department of Revenue released Information Letter 23-16, setting forth the updated per capita income level for the state at $53,618, up from $52,467 a year earlier. Please access the link to view the county per capita income levels. The state per capita income is relevant for the small business job tax credit, in which a taxpayer with 99 or fewer employees in an eligible industry increases employment by two or more new, full-time jobs. If the average wages of those jobs do not exceed 120% of the lower of the county or state average per capita income, the credits are cut in half. Notably, if the small business creates ten or more new, full-time jobs, the business qualifies for the full amount of job tax credits without regard to wages.

In addition, the state per capita income is relevant for purposes of defining a "qualifying service-related facility," which is applicable for both job tax credits and job development credits and which has become an increasingly important avenue for non-manufacturing businesses to qualify for key South Carolina incentives. Further, the figure is relevant to technology-intensive facilities for determining eligibility for the sales and use tax exemption for computer equipment, as well as for the state income tax credit on personal property expenditures associated with corporate headquarters projects.

Finally, job development credits are usually provided only for jobs paying at or above the county per capita income level at the time the initial application is approved (and adjusted every five years thereafter).

Tax Credit Reminders for 2024

Port Cargo Volume Credit

South Carolina Code § 12-6-3375 provides a tax credit to a taxpayer engaged in manufacturing, warehousing, or distribution that uses South Carolina port facilities and increases its port cargo volume at these facilities by at least 5% in a calendar year over its base year port cargo volume. Base year volume must be at least 75 net tons of non-containerized cargo, 385 cubic meters, or ten twenty-foot equivalent units. Form TC-30, "Port Cargo Volume Increase," is used to claim the credit.

It is important to note that tax credit applications should be submitted early in the year as the maximum amount that all taxpayers may claim pursuant to this section is subject to an annual cap. Tax credits may be taken against state income tax or as withholding tax refunds.

Agricultural Tax Credit

In 2018, South Carolina introduced a new program that provides a tax credit to agribusiness or agricultural packaging operations increasing their purchases of South Carolina agricultural products. If the "base year" of a company's purchases exceeded $100,000, and the company increased such purchases by at least 15%, the company can submit an application for credits against either state income or withholding taxes. The amount of the credits is determined by the South Carolina Coordinating Council, based on the information provided in the application. The credit may not exceed $100,000 per taxpayer in any one year. As with port cargo volume credits, these credits are also subject to an annual, statewide cap, so qualifying taxpayers should apply for credits as early in the year as possible.

Assessable Transfer of Interest Exemption

Taxpayers who purchased commercial (non-manufacturing) property in 2023 (or who own property which underwent an assessable transfer of interest (ATI) as defined in the South Carolina Real Property Valuation Reform Act) should consider taking advantage of statutory limitations on property tax increases for property taxed at a 6% assessment ratio. Taxpayers qualify for an “ATI exemption” equal to 25% of the fair market value of property that has undergone an ATI in 2023, provided that the ATI exemption may not reduce the taxable value of the property below the fair market value of the property prior to the ATI. In order to benefit from this limitation, the property owner must provide written notice to the applicable county assessor before January 30 of the year following the transfer. Taxpayers must proactively make the filing to capture the benefit of the ATI exemption. Failure to make the filing results in loss of this important benefit.

Click here to view the full update. Contact Will Johnson or a member of our Economic Development team for additional information on these topics or other economic development questions.